How the U.S. Government Could End the Student Debt Crisis Today

Photo by Shutterstock.

Last month, Lower Saxony became the final state in Germany to abolish tuition for all students at public universities. Meanwhile, in the United States, student loan debt has passed the $1 trillion mark. The burden is now becoming increasingly heavy for middle-class and wealthy students, but especially for those from lower-income backgrounds. This injustice has spurred many organizations, like the Occupy Wall Street offshoot Strike Debt, to do what they can to pay off student debton their own.

The student-debt status quo taxes borrowers while doing less and less to subsidize social mobility.

Borrowers could use the support of their government, but U.S. policymakers don’t seem to see student debt through the same moral lens as officials in many other countries do. Can you imagine Secretary of Education Arne Duncan, for example, arguing that “Tuition fees are socially unjust,” as German member of Parliament Dorothee Stapelfeldt told The Times of London? Or even, as she went on to say, that, “[fees] particularly discourage young people who do not have a traditional academic family background from taking up studies”?

Instead, higher education is peddled as the ticket to economic security by the federal government, commercial lenders, and universities—no matter the cost. Policies that would reduce the fear of unemployment, like the Job Guarantee programs supported by President Franklin Delano Roosevelt and demanded by Martin Luther King Jr., might make it more feasible for young people to opt out of college. Yet policymakers in the United States seem unwilling to consider such options.

Thus, as sociologist Tressie McMillan Cottom has argued, many young Americans, especially people of color, are desperate for higher education. Yet day by day, the student-debt status quo taxes borrowers while doing less and less to subsidize social mobility.

But the worst part is that it doesn’t have to be this way. To put it bluntly, there is no fiscal reason why the U.S. student debt crisis should exist.

At a basic level, the U.S. federal government doesn’t need to scrimp and save to fully fund higher education. It can just spend money rather than lend it, without incurring any significant negative economic consequences. Although I’d love to reduce spending on, say, prisons, the federal government doesn’t even need to take money out of other programs in order to alleviate student debt.

You may find this argument hard to believe. The way most politicians and journalists talk about the national debt and deficit spending makes free higher education sound impossible. But there’s another way of looking at the problem, a vision advocated by a growing movement of economists, lawyers, students, and financial practitioners who deal with the institutional nuts and bolts of the economy on a day-to-day basis.

Uncle Sam can’t go broke

When progressives advocate for more federal spending on education, the rejoinder is often something like: “OK, but how are you going to pay for it?” Progressives then either fall silent or perform fiscal gymnastics.

But we shouldn’t bow to those discussion terms.

Uncle Sam isn’t broke. In fact, the U.S. federal government can’t go broke.

First things first: Uncle Sam isn’t broke. In fact, the U.S. federal government can’t go broke. Up until August 1971, the amount of dollars in the world was pegged to the amount of gold in federal vaults. But it hasn’t been that way since we left the gold standard four decades ago. When Congress spends, the Treasury simply asks the Federal Reserve to add or remove money from bank accounts with keystrokes. The dollars don’t come from anywhere else. Unlike a business or a household, the federal government spends money into existence.

From this perspective, the U.S. ceased to be capable of “going broke.” Many economists known as “deficit owls ” have argued for decades that the U.S. federal government doesn’t need tax revenues or bond payments in order to spend money on education or anything else. Rather, the true limits to federal spending are the availability of real resources and the stability of prices. Noted hippies like Alan Greenspan, Ben Bernanke, and economists at the St. Louis Federal Reserve have all publicly stated as much.

The fiscal framework of the U.S. government is thus different from that of, say, Detroit—which cannot print its own dollars—or Greece, which now uses euros and can no longer print drachmas. As Warren Buffet stated in 2011, “We’ve got the right to print our own money. That’s the key.”

So why do politicians and others keep insisting that the U.S. government can’t afford to spend money on education? The notion reflects a confused picture of how our economy actually works.

When people think of federal spending, they often imagine that the government collects money from taxpayers and foreign investors (i.e., China), and then redistributes it for various purposes.

But this picture doesn’t reflect how things are really done. The federal government instead spends money into the real economy and drains it via taxes and bonds.

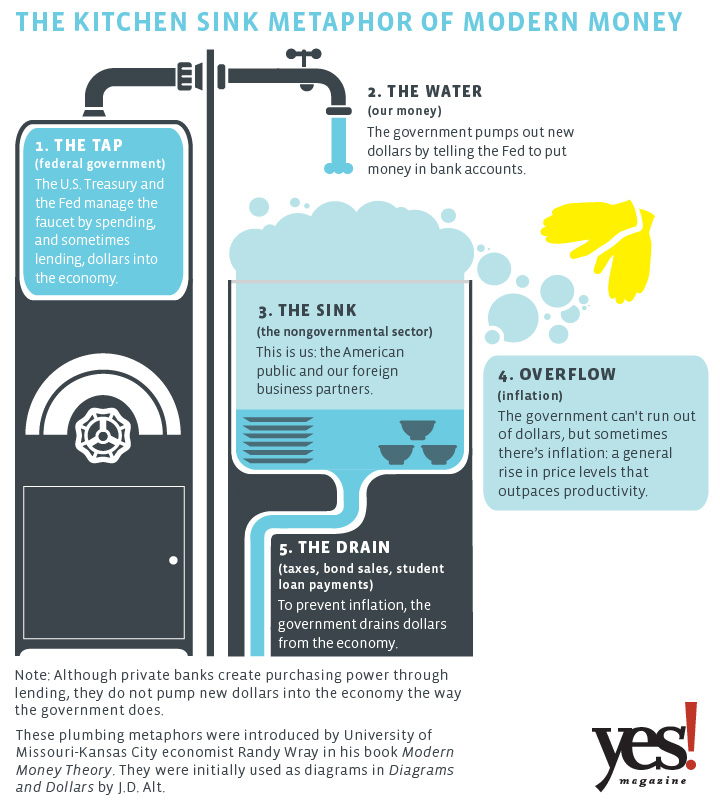

Imagine the economy as a sink full of dishes, with the federal government in control of a tap. In order for us to do the dishes, we need enough water but not so much that our sink overflows. To keep the sink from overflowing, we can open a drain, which removes water from the sink. This is the main macroeconomic function of federal taxes: to drain money from the economy and thus prevent inflation.

Infographic by Jim McGowan.

Education spending, lending, and inflation

Despite what politicians often say, pumping more money into the economy by running a deficit does not necessarily cause inflation—that is, a general, continuous rise in prices across the economy.

Rather, enduring effects on prices depend upon many factors, including where money goes and what kind of demand it stimulates. Notably, in modern U.S. history, inflation has typically arisen from actions taken by parties other than the U.S. government. For example, inflation during the 1970s can be chiefly attributed to OPEC spiking oil prices, which exacerbated commodity speculation and caused wages and prices to spiral in other sectors. Federal spending was not the culprit.

Inflation can occasionally result from “too much money chasing too few goods.” But as any credible economic forecaster will tell you, this is not a salient concern for the U.S. economy right now.

In any case, worries about inflation aren’t particularly relevant to a change in funding for higher education. It’s important to remember that the government is already pumping new money into the higher education sector; it just does it in the form of loans instead of spending.

Just as importantly, private banks are also creating new “money” every day via student loans, with few people ringing the inflation alarm. As the Bank of England recently detailed, private banks in the modern era do not lend pre-existing funds, but instead create credit “out of thin air” as they lend. When you receive a loan, the bank places funds in your account, simultaneously expanding both the asset and liability sides of its own balance sheet. Again, the dollars don’t come from anywhere—they’re new.

There’s no good reason for students’ pockets to be shallow when the government’s are deep.

The point is, if you’re not worried about lending causing inflation right now, you shouldn’t be worried about robust government spending causing inflation either.

So if there’s no economic harm from public funding for higher education, why do young people like 24-year-old Nathan Hornes have college degrees, tens of thousands of dollars in debt, but no full-time job?

As Stephanie Kelton, chair of the economics department at the University of Missouri, Kansas City, recently argued in a seminar on student debt, the problem is “austerity memes” and related myths about inflation. Instead of funding education like a public good, the government is going in the wrong direction, spending almost 10 percent less on total federal aid now than it did in 2010.

Who should owe whom?

If money should be owed for higher education at all, perhaps the federal government should owe us. After all, Article I, Section 8 of the Constitution entrusts the federal government with a monopoly to create, spend, and regulate money for the “general welfare of the United States.” And in the era of modern money, there’s no good economic reason for students’ pockets to be so shallow when the government’s are so deep.

When the federal government lists a deficit, that indicates a surplus for American citizens, as well as foreign businesses that sell us goods. In other words, the government’s red ink is the public’s black ink. Despite what organizations with wholesome and appealing names like Fix the Debt, The Can Kicks Back, and Up To Us, might claim, the “national debt” is not a burden for young people. Indeed, advocating for smaller federal deficits hurts student debtors. Even in the future, it offers them no tangible benefits.

As the Nobel-winning economist Paul Samuelson once acknowledged, the “superstition” that the budget must be balanced at all times is part of an “old fashioned religion,” meant to hush people who might otherwise demand the government create more money. Young people should beware of anyone who tells them that their chief worry for the future is the government’s debt, rather than their own.