The Affordable Housing Issue: In Depth

- A New Generation Lives a Different American Dream—And They’re Happy

- Share

Britni de la Cretaz, 33, a freelance journalist who lives in the Boston area with her husband and children, didn’t want to give up on the idea of homeownership. But they had to contend with the uncertainty of contract work.

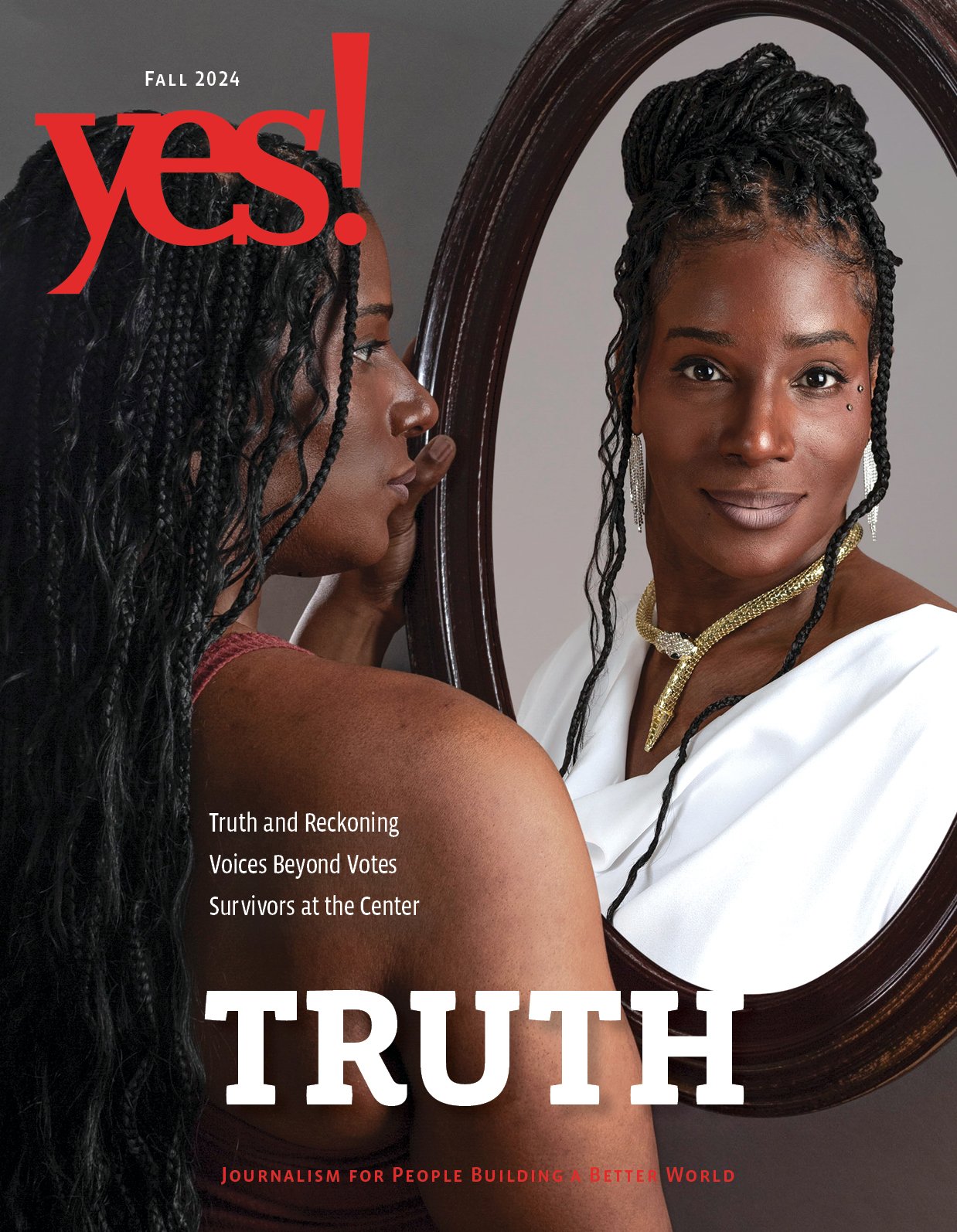

Photo by Jesse Stansfield.

A New Generation Lives a Different American Dream—And They’re Happy

Millennials, sometimes referred to as “generation rent,” are having to get creative and find alternative housing options.

It’s no surprise to anyone that the housing market of 2018 isn’t the same as the one 40 years ago. But what it means for young people piecing together careers is that they can’t expect to afford the same houses and lifestyles their parents’ generation was able to obtain.

Millennials, sometimes referred to as “generation rent,” are having to get creative and find alternatives. And for many of them, it’s working just fine.

Britni de la Cretaz, 33, a freelance journalist who lives in the Boston area with her husband and children, didn’t want to give up on the idea of homeownership. But she and her husband, who works as a consultant, also had to cope with the financial uncertainty that usually accompanies contract work. Instead of opting out, they bought a house, then rented out the ground floor.

“We never wanted to worry about not being able to pay our mortgage, so we intentionally sought out a two-family home so we would always have rental income, even if our job situation became precarious,” de la Cretaz says.

“A consequence of coming of age during an economic recession is missing out on many of the employment benefits seen by previous generations,” says Nancy Worth, an assistant professor of geography at the University of Waterloo in Waterloo, Ontario. She uses generational analysis through her project, GenYatHome, to examine how people born at a particular time share experiences. “Their experience is with a job market characterized by flexibility and precarity. Jobs with full benefits are something most millennials have never known.”

The financial burden faced by many young people is formidable. About 1 in 3 millennials lives with their parents because of the combined burden of student loans, a competitive multigenerational job market, and rising mortgage rates, according to the U.S. Census Bureau. Rising costs are a barrier to home-buying, especially for millennials. As if cost isn’t a big enough obstacle, there’s a significant inventory shortage in many cities.

The problem isn’t just for home buyers; renters are also struggling. According to the Harvard Joint Center for Housing Studies, 11.1 million renters in the U.S. spent more than 50 percent of their income on housing.

Millennials are creating their own version of success, Worth says, even though it looks different from previous generations’ picture of the American Dream.

Lynn Brown, 28, refused to let the housing market and rising costs of living stop her from enjoying life. For her, financial stability was a higher priority than having a permanent roof over her head.

So, technically, she’s homeless. But happy.

She says the only thing she’s had to give up is other people’s timelines. “There’s this idea that in your 30s you should be settling down and having a family and that kind of thing. Like the only thing I feel like I’ve sacrificed is the mentality of where I’m supposed to be at my age and what I’m supposed to be doing,” Brown says.

“As housing becomes nontraditional in all these different ways, there are lots of innovations of work that are happening.”

Before committing to a nomadic lifestyle, Brown sought out more traditional means of cost-effective housing. “In the past, I’ve tried to either live in cheaper areas or live in communal housing.”

While living in the San Francisco Bay Area, she shared a historic house with eight other people. “But I’m not really a fan of roommates, which made it difficult,” she says.

She was always enamored with the idea of traveling constantly, but the end of a relationship finally gave her the push to get started. “Instead of finding a new place to live, [I] just decided to fulfill my fantasy of traveling constantly. I cut down my belongings to eight boxes and two suitcases—put the boxes in storage in my mother’s basement and carry the essentials with me in my suitcases.”

Brown started freelance writing about travel and history as a way to make income on the go.

“For a lot of young people in this generation, work has a new normal, compared to their parents and grandparents,” Worth says, discussing how many millennials have unique and flexible work.

They’re as flexible with work as they are with housing, changing jobs often. A recent Gallup poll found that 45 percent of millennials would change jobs for student loan reimbursement and tuition reimbursement, and 50 percent would change jobs for part-time flex work options.

“Part of the wider story is thinking about how housing, work, and our social lives fit together,” Worth says. “As housing becomes nontraditional in all these different ways, there are lots of innovations of work that are happening, as well as trying to make work possible but also fulfilling.”

Millennials are known for embracing the gig economy, a work style characterized by a series of contract jobs and short-term assignments. Self-employment and fluctuating income make it a lot more difficult to buy a house.

Worth believes variations of de la Cretaz’s home-sharing structure are common for individuals doing freelance work. Housing coping strategies, she says, are useful for those with freelance or contract jobs, who don’t necessarily want to be the only name on a long-term lease.

For de la Cretaz, there were other perks.

“It gave us housing stability, allowed us to begin saving for retirement, provided childcare help for us when we had other people living in our home, and gave friends and community members a place to live when they needed it,” she says.

“The idea of what’s normal has really changed.”

Alaina Leary, 25, works in publishing from home and opted to live in Quincy, a town in the Boston area with a lower cost of living.

“It has no doubt saved me a lot of money and time. It’s time I now spend working and making money, and even the extra 2–3 hours per day five days a week has yielded thousands of extra dollars in my savings account over 2017 and early 2018,” Leary says.

While these approaches are innovative, Worth says, they’re choices being made not just from a cultural standpoint, but also out of necessity.

“If you look at the baby boomers, a lot of them were able to move out by their late teens even and had permanent full-time jobs with benefits in their 20s, but within one generation that’s really changed,” Worth says. “The idea of what’s normal has really changed. Young people typically look to their parents for what to expect, but nothing is the same in terms of wider social conditions around work, housing, and family life.”

The nonprofit policy research organization Generation Squeeze estimates it took five years to save a 20 percent down payment in 1976, compared to 13–27 years today. Many Americans are no longer able to make a 20 percent down payment.

But interestingly, Worth says, millennials seem to be less bothered by communal living situations. “One in three people surveyed responded with ‘I lived at home because I want to stay with my parents,’” she says. “That isn’t necessarily new with the millennial generation, but it’s an unreflected-upon part of why millennials live at home, this idea of generational interconnectedness and helping each other cope in times of economic stress.”

“I’m taking this time of not having rent to save up some money and decide where I want to settle down long term—or if I want to settle down at all,” Brown says.